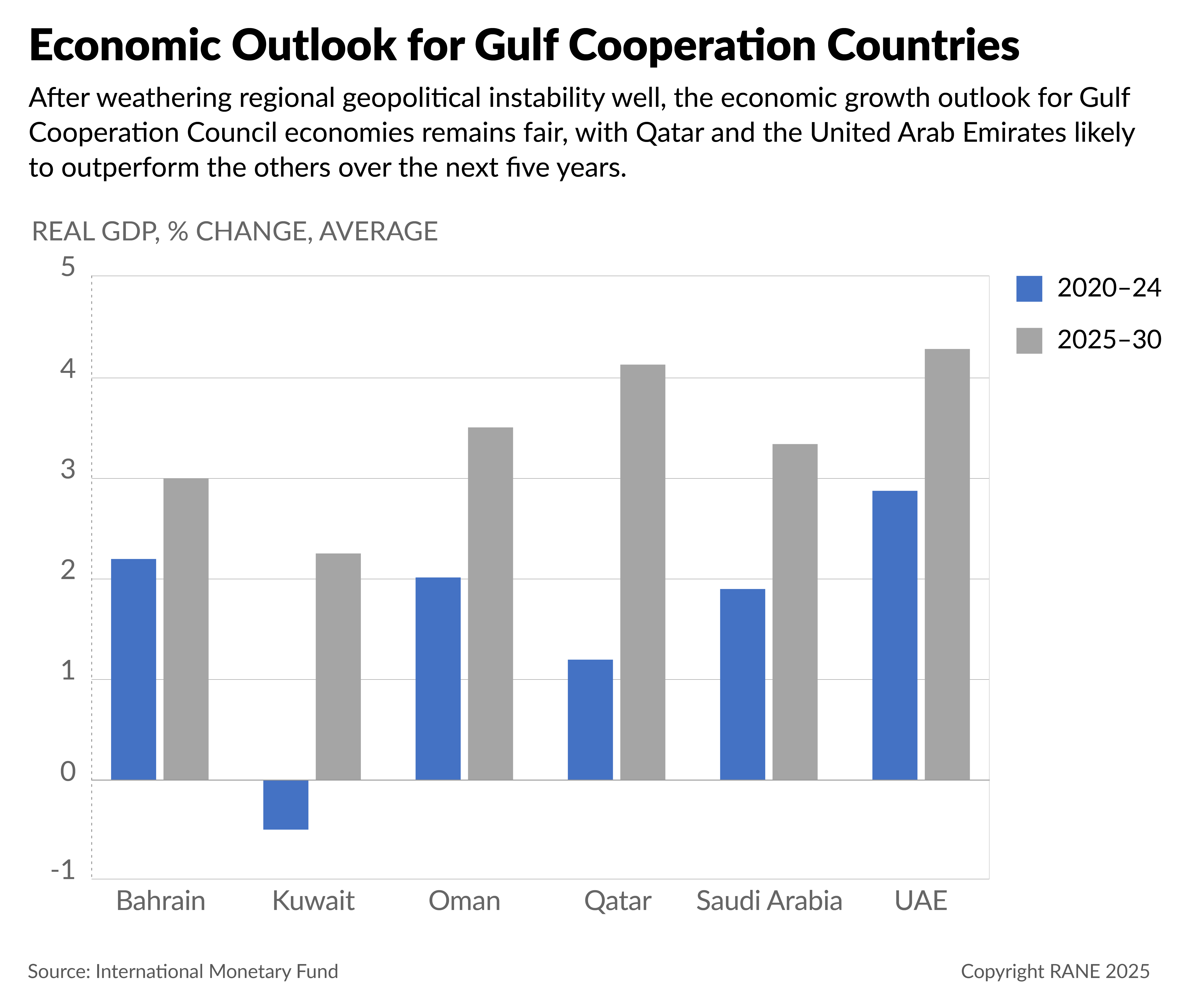

Gulf Arab states' solid macroeconomic and financial fundamentals will keep the region resilient in the face of global economic uncertainty, including a potential sustained drop in oil prices over the next few quarters. According to the International Monetary Fund (IMF), the members of the Gulf Cooperation Council (GCC) are expected to sustain solid economic growth over the next five years against the backdrop of low inflation and strong current account and external financial positions. Oil prices and production levels, particularly in the case of swing producers like Saudi Arabia and the United Arab Emirates, will continue to strongly contribute to economic growth, despite Gulf states' decades-long and ongoing efforts to diversify away from oil and gas production. Across the region, ongoing structural reform has helped increase the share of the non-hydrocarbon economy, though Kuwait, Qatar and Saudi Arabia remain highly reliant on oil and gas exports. By comparison, Bahrain and the United Arab Emirates have made greater progress toward diversification by developing their tourism, finance, logistics and manufacturing sectors, making their growth less sensitive to fluctuations in global hydrocarbon production and prices. But by international standards, all GCC economies remain highly susceptible to oil price volatility, especially prolonged downturns. A sustained decline in oil prices constrains government spending and often government investment, which in turn leads to slower near- and medium-term economic growth.

GCC countries have enough fiscal and external buffers to counter the fallout from a worsening international economic climate, though a further decline in oil prices would still negatively affect their balance-of-payments and fiscal accounts. Global oil prices have remained above $60 per barrel year-to-date and are unlikely to fall much below this level for the rest of the year, barring a significant global economic downturn. With the exceptions of Saudi Arabia and Bahrain, all GCC countries are projected to maintain both fiscal and external surpluses under any realistic oil price scenario. All GCC nations (excluding Bahrain) have also accumulated large financial buffers to withstand even prolonged oil price weakness, including significant budget surpluses and large sovereign wealth funds. Any short-term budget shortfalls would thus have a limited impact due to existing budget surpluses, accumulated budget savings, or, in Saudi Arabia's case, a considerable ability to finance larger-than-anticipated budget deficits in the market. GCC central banks also have sufficiently large foreign-exchange reserves to maintain their dollar pegs. Additionally, GCC banking systems are well-capitalized, liquid and profitable so as not to be a significant source of contingent liabilities for their government or a source of significant macro risk. Large fiscal surpluses across most GCC countries (with the exceptions of Saudi Arabia and Bahrain) mean that a moderate dip in oil prices would only lead to reduced budget surpluses. This would result in somewhat lower economic growth, but no major changes to fiscal policy in the region. Only Bahrain is fiscally constrained, while Saudi Arabia could easily finance a budget shortfall by increasing government debt. And as in the past, if Bahrain got into trouble, it could count on the other GCC countries to provide financial support to avoid a broader financial, economic and political destabilization of the country. As a result, a financial crisis remains unlikely in any GCC country. But sustained lower oil prices would still increase pressure on governments to advance structural reforms, including economic diversification and tax reform, to make economic activity and financial performance less directly dependent on oil prices.

Saudi Arabia, the largest economy in the GCC, has shown significant resilience in the face of recent external shocks and will continue to do so, even if lower oil revenues force it to scale back costly government-led infrastructure investments. Non-hydrocarbon economic activity in Saudi Arabia has been expanding, driven by largely government-led investments geared toward economic development and diversification under Vision 2030. This expansion has coincided with sustained low inflation and record-low unemployment rates. The kingdom's external and fiscal buffers also remain significant, despite modest current and fiscal deficits. A sharp decline in global oil prices and output would negatively affect economic growth in Saudi Arabia, given its substantial spare oil production capacity and history of acting as a swing producer. However, the country's ability to run a counter-cyclical fiscal policy and sustain investment spending would mitigate the impact on economic growth, which is set to reach 3.5% in 2025 and 3.9% in 2026, per the IMF. It would take a massive drop in oil prices, which is unlikely, for Saudi economic growth to decelerate to 2024 levels of 1.8%.

The outlook for the United Arab Emirates, the second-largest GCC economy, is very strong due to the country's greater economic diversification and its role as the regional business hub. The region's improving economic stability particularly benefits the United Arab Emirates due to its more diversified economy and historically superior growth potential compared to the other GCC economies. Against this backdrop, UAE economic growth is set to accelerate this year to reach 4%, up from last year's 3.8%, before accelerating to 5% next year. The country's fiscal balance will remain in substantial surplus at around 5% of GDP, while gross government debt will remain at a modest 30% of GDP. The United Arab Emirates' net international investment position will also continue to improve due to sustained large current account surpluses of nearly 10% of GDP.

The outlook for the smaller GCC countries — Qatar, Kuwait, Oman and Bahrain — is slightly less favorable, but still fair. Inflation will average a modest 1-3% across all four countries in 2025 and 2026, while real GDP growth will average a solid 3-4% in 2025-26. Qatar, Kuwait and Bahrain are set to register real GDP growth of 1.9-2.5% in 2025, before accelerating to more than 3% in 2026. Oman, meanwhile, is predicted to see real GDP growth of 5-6% due to increased gas exports and especially transport-related services output (e.g., port, cargo and shipping). These growth forecasts are based on oil prices remaining around $67 per barrel, which is Brent crude's average price year-to-date. The stable inflation outlook in all four countries also means that growth-inflation dynamics, combined with ample fiscal flexibility, are unlikely to lead to increasing levels of domestic political discontent.